HOW DO I OPT OUT?

Fill out an application attesting to the Employment Security Department (ESD) that you have purchased private long-term care insurance. You will receive a letter from ESD showing that your exemption was approved. Show the ESD letter with their approval to your current and any future employers to ensure you’re permanently exempt from paying the payroll tax.

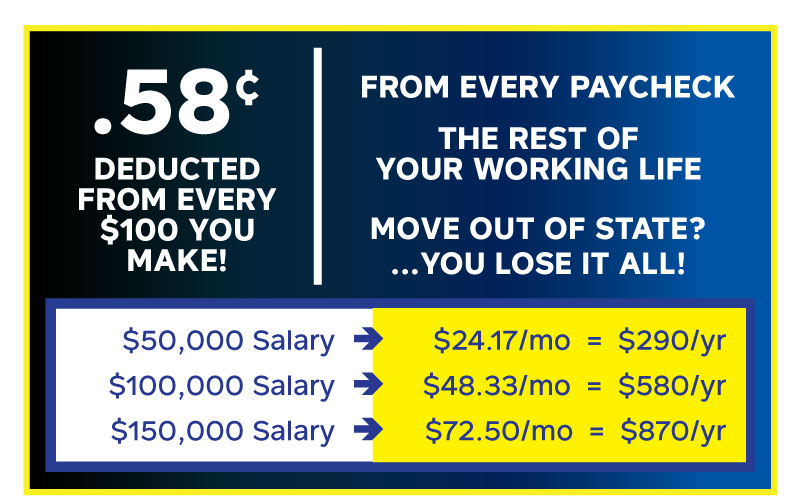

The WA Cares Fund program may meet the needs of some, while others may find private long-term care insurance to be a better option.